By Joey Gunning, Director of Economic Development, Greater Spokane Inc.

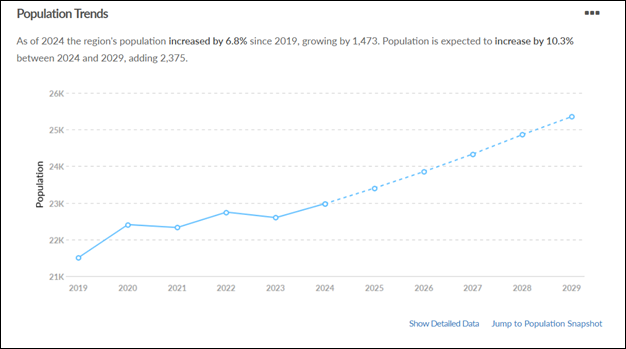

Cheney, Washington is growing…fast. Since 2019, the population has increased by 6.8%, adding about 1,500 new residents. With projections suggesting another 10.3% growth over the next five years, that’s an influx of about 2,375 additional people.

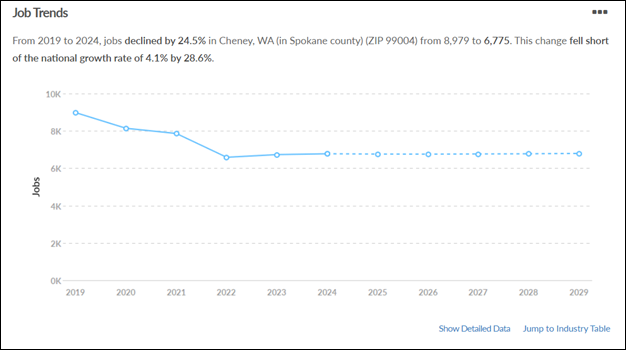

But despite these positive demographic trends, Cheney’s job market has been moving in the opposite direction. Since 2019, the total number of jobs has fallen by 24.5%, dropping from about 9,000 to just 6,775 – a loss of over 2,000 positions in five years.

So where are all these newcomers working? They’re commuting.

In 2024, a staggering 6,811 residents lefts Cheney every day for work elsewhere – nearly 30% of the city’s population. This high outbound commuter rate is reshaping Cheney’s economic landscape and its connections to the Spokane region.

The Spokane Transit Authority (STA) is responding to this trend. Double-decker buses are being introduced on the Cheney-to Spokane route, recognizing that the need for efficient public transport is only going to grow as more people search for job opportunities outside their hometown.

In addition, new parks such as the Camas Meadows Park, are being developed on the West Plains, signaling investment in community spaces for residents.

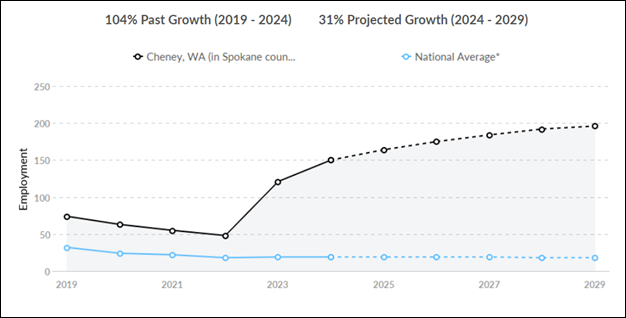

But while jobs overall have declined, there is one industry local to Cheney that is growing. That is, Mining, Quarrying, and Oil & Gas Extraction. Cheney employs 600% more workers in this industry than the national average for a city its size. Though the absolute number is modest (150 employees), that workforce has more than doubled over the past five years, with another 31% growth projected.

While Cheney isn’t widely recognized for mining, data suggests that a specific niche within the sector – likely tied to materials extraction and aggregates – is expanding rapidly. These operations largely service regional infrastructure and construction projects, creating a unique opportunity for Cheney.

But there’s a flip side. In 2024, a striking 93% of purchases made from Mining, Quarrying, and Oil & Gas Extraction in Cheney were imported from outside the region, amounting to $22.8 million. So while the industry is growing, the economic benefits are leaking outward.

Those imports include big-ticket services like Corporate Management, Portfolio and Investment Advice, Construction and Equipment Leasing, and Commercial Banking. This points to a local economy that is deeply reliant on external services. So while the jobs may be here, the value creation is happening elsewhere.

So what can Cheney do?

- Localize the Supply Web: Focus on secondary services that support extraction operations. Incentivize regional banks and insurance companies to serve Cheney’s industrial base, redirecting high-value service spending back into the local economy. Create tax incentives for local companies that commit to sourcing a percentage of their materials and services locally.

- Attract Industrial Support Firms: Use the momentum of the industry to identify and recruit businesses that can supply materials and services essential to this sector, decreasing the reliance on outside imports.

- Networking: Organize forums that connect local entrepreneurs with industry leaders to cultivate business relationships that can lead to increased local procurement.

Cheney is home to a burgeoning industry, but not yet to a thriving industrial economy. That’s the difference between doing the work and owning the ecosystem. With some strategic investments in the support systems around the Mining, Quarrying, and Oil & Gas Extraction industry, Cheney has the opportunity to shift from being a pass-through economy to one that builds and benefits from its own growth.

In other words, Cheney’s mining sector is digging deep. And with the right moves, the real gold may just be able to stick around.

Consider this: health care is currently Liberty Lake’s 4th largest industry (by employment) but lags 30% behind the national average for an area its size. Lightcast projects 10% growth over the next five years. However, given Liberty Lake’s similarities with Silicon Valley and its high concentration of remote workers, combined with Evergreen Bioscience’s work to bolster the industry in the entire region, the conditions are ripe for health care to become Liberty Lake’s fastest-growing industry over the next decade.

In many ways, Liberty Lake is positioning itself as the “Silicon Valley of the Inland Northwest.” Its unique blend of growth, innovation, and workforce talent could transform it into a regional leader – not just in remote work or tech but in redefining what a small city can achieve.

Liberty Lake might not be Silicon Valley quite yet, but it’s proving you don’t need a coast to ride the wave of innovation.